Risk Management Software Market Opportunities and Trends Shaping the Industry

Executive Summary Risk Management Software Market Research: Share and Size Intelligence

CAGR Value

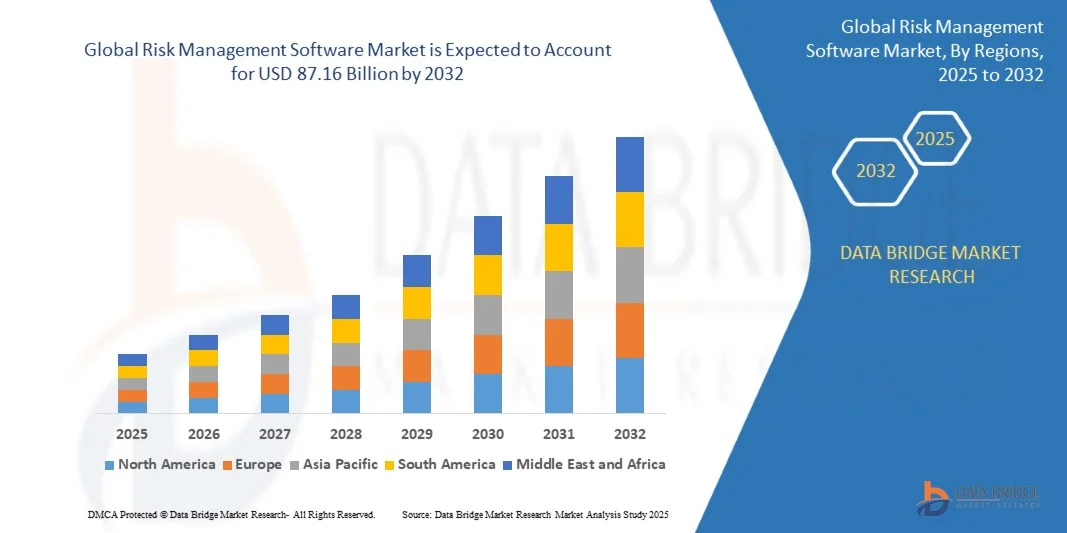

- The Risk Management Software Market size was valued at USD 41.40 billion in 2024 and is projected to reach USD 87.16 billion by 2032, growing at a CAGR of 9.75% during the forecast period.

- The market expansion is primarily driven by the rising need for regulatory compliance, real-time risk assessment, and enhanced decision-making tools across industries, particularly in finance, healthcare, and IT sectors.

- Additionally, the increasing integration of AI, machine learning, and cloud-based platforms into risk management software is transforming organizational capabilities, thereby accelerating adoption and significantly propelling market growth.

The large scale Risk Management Software Market report gives explanation about the different segments of the market analysis which is demanded by today’s businesses. The process of formulating this market report is initiated with the expert advice and the utilization of several steps. Market share analysis and key trend analysis are the major accomplishing factors of this winning market report. Evaluations of CAGR values, market drivers and market restraints aid businesses in deciding several strategies. Moreover, Risk Management Software Market research report also brings into the focus various strategies that have been used by other key players of the market or Risk Management Software Market industry.

All the statistics covered in the world class Risk Management Software Market report is represented in a proper way with the help of graphs, tables and charts which gives best user experience and understanding. Also, the reviews about key players, major collaborations, merger and acquisitions along with trending innovation and business policies are displayed in this market report. This market study also evaluates the market status, market share, growth rate, sales volume, future trends, market drivers, market restraints, revenue generation, opportunities and challenges, risks and entry barriers, sales channels, and distributors. Risk Management Software Market research report is sure to help businesses in making informed and better decisions thereby managing Market of goods and services.

Find out what’s next for the Risk Management Software Market with exclusive insights and opportunities. Download full report:

https://www.databridgemarketresearch.com/reports/global-risk-management-software-market

Risk Management Software Market Dynamics

Segments

- On the basis of the component, the risk management software market can be segmented into software and services. The software segment includes standalone software solutions, while the services segment encompasses consulting, training, and support services.

- By deployment model, the market is categorized into cloud-based and on-premises. Cloud-based deployment is gaining traction due to its scalability and cost-effectiveness.

- In terms of organization size, the market can be classified into small and medium-sized enterprises (SMEs) and large enterprises. SMEs are increasingly adopting risk management software to improve their operational efficiency and compliance.

- Based on industry vertical, the market is segmented into banking, financial services, and insurance (BFSI), healthcare, IT and telecom, manufacturing, retail, and others. Each vertical has unique risk management requirements, driving the demand for specialized software solutions.

- Geographically, the global risk management software market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America dominates the market due to the presence of key market players and stringent regulatory requirements.

Market Players

- IBM Corporation

- SAP SE

- SAS Institute Inc.

- Moody's Analytics

- Oracle Corporation

- Fidelity National Information Services, Inc.

- Verisk Analytics, Inc.

- Thomson Reuters

- MetricStream Inc.

- Resolver Inc.

The global risk management software market is witnessing significant growth due to the increasing focus on compliance management, growing cybersecurity threats, and the need for operational efficiency. Market players are investing in research and development to offer advanced risk management solutions that cater to the evolving needs of organizations across different industry verticals. The adoption of risk management software is expected to surge further as businesses aim to mitigate risks and enhance decision-making processes. The market is highly competitive, with key players emphasizing partnerships, acquisitions, and product innovations to gain a competitive edge.

The global risk management software market is poised for continued growth driven by several key factors. One emerging trend in the market is the increasing focus on integrated risk management (IRM) solutions that offer a holistic approach to managing various types of risks faced by organizations. IRM solutions combine traditional risk management practices with emerging technologies such as AI, machine learning, and predictive analytics to provide real-time insights and enhance decision-making capabilities. This trend is particularly relevant in industries such as banking, financial services, and insurance (BFSI) where regulatory compliance and cybersecurity threats are paramount.

Another significant development in the market is the adoption of cloud-based risk management software solutions. Cloud deployment offers several advantages such as scalability, flexibility, and cost-effectiveness, making it an attractive option for organizations of all sizes. With the increasing emphasis on remote work and digital transformation, cloud-based risk management solutions enable seamless access to critical risk data and analytics from anywhere, at any time. This shift towards cloud-based solutions is expected to drive market growth further as organizations seek to modernize their risk management processes.

Furthermore, the COVID-19 pandemic has accelerated the digitization of risk management practices as businesses strive to manage risks associated with supply chain disruptions, remote operations, and economic uncertainties. This has led to an increased demand for advanced risk management software that can provide real-time monitoring, scenario analysis, and predictive modeling capabilities to help organizations navigate through turbulent times. Market players are leveraging this opportunity to develop innovative solutions that address the evolving needs of organizations in a post-pandemic world.

In terms of market competition, key players such as IBM Corporation, SAP SE, and SAS Institute Inc. continue to dominate the global risk management software market with their comprehensive product offerings and strong industry expertise. These players are focusing on strategic partnerships and collaborations to expand their market presence and enhance their product portfolios. Additionally, emerging players like MetricStream Inc. and Resolver Inc. are gaining traction by offering niche solutions tailored to specific industry verticals or risk management requirements.

Looking ahead, the global risk management software market is expected to witness sustained growth driven by the increasing complexity of risks faced by organizations, regulatory pressures, and the growing awareness of the importance of proactive risk management. Market players that can effectively adapt to these evolving market dynamics and offer innovative, integrated solutions are likely to experience continued success in this competitive landscape.The global risk management software market is poised for robust growth driven by several key factors that are reshaping the industry landscape. One of the emerging trends in the market is the increasing demand for integrated risk management (IRM) solutions that offer a comprehensive approach to addressing various risks faced by organizations. IRM solutions integrate traditional risk management practices with cutting-edge technologies such as artificial intelligence, machine learning, and predictive analytics to provide real-time insights and enhance decision-making capabilities. This shift towards IRM solutions is particularly relevant in industries like banking, financial services, and insurance (BFSI) where regulatory compliance and cybersecurity concerns are critical.

Another notable trend in the market is the rapid adoption of cloud-based risk management software solutions. Cloud deployment offers multiple benefits including scalability, flexibility, and cost-effectiveness, making it an attractive choice for organizations of all sizes. The increasing emphasis on remote work and digital transformation further propels the adoption of cloud-based risk management solutions. These solutions enable seamless access to crucial risk data and analytics from any location, at any time, contributing to enhanced operational efficiency and risk mitigation strategies.

Moreover, the COVID-19 pandemic has accelerated the digitization of risk management practices as businesses strive to navigate through unprecedented challenges such as supply chain disruptions, remote operations, and economic uncertainties. This has triggered a heightened demand for advanced risk management software that can deliver real-time monitoring, scenario analysis, and predictive modeling capabilities to help organizations respond effectively to evolving risks. Market players are leveraging this opportunity to develop innovative solutions that cater to the changing needs of organizations in a post-pandemic era.

In terms of market competition, established players such as IBM Corporation, SAP SE, and SAS Institute Inc. maintain a strong foothold in the global risk management software market by offering comprehensive product suites and leveraging their industry expertise. These market leaders are focusing on strategic collaborations and partnerships to expand their market reach and enhance their solution portfolios. Additionally, emerging players like MetricStream Inc. and Resolver Inc. are gaining momentum by providing specialized solutions tailored to specific industry verticals or risk management requirements, thereby contributing to a more diverse and competitive market landscape.

Looking ahead, the global risk management software market is expected to witness sustained growth fueled by the escalating complexity of risks faced by organizations, regulatory pressures, and the growing recognition of the significance of proactive risk management practices. Market participants that can swiftly adapt to the evolving market dynamics, deliver innovative, integrated solutions, and effectively address the shifting needs of organizations are likely to thrive in this dynamic and competitive market environment.

Track the company’s evolving market share

https://www.databridgemarketresearch.com/reports/global-risk-management-software-market/companies

Master List of Market Research Questions – Risk Management Software Market Focus

- What is the size of the Risk Management Software Market based on the latest report?

- How is the market expected to grow annually?

- Which components make up the primary segmentation?

- Who are the most influential firms in the current landscape?

- What are some recent product or service launches?

- Which countries are covered in the scope of the Risk Management Software Market report?

- What region is demonstrating the highest Risk Management Software Market momentum?

- Which country will likely dominate future trends for Risk Management Software Market?

- Which area leads in terms of Risk Management Software Market occupancy?

- Which country holds the top position for CAGR?

Browse More Reports:

Europe Secondary Hyperoxaluria Drug Market

Middle East and Africa Secondary Hyperoxaluria Drug Market

Asia-Pacific Secondary Hyperoxaluria Drug Market

North America Secondary Hyperoxaluria Drug Market

Europe Semiconductor Manufacturing Equipment Market

North America Semiconductor Manufacturing Equipment Market

U.S. Smart Hospitality Market

Europe Tannin Market

North America Tannin Market

Europe Telecom Expense Management Market

Middle East and Africa Telecom Expense Management Market

U.S. Telestroke Market

Europe Textile Films Market

Asia-Pacific Textile Films Market

Middle East and Africa Textile Films Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com