Aircraft Seating Market Set to Reach New Heights with Sustainable Design Innovations

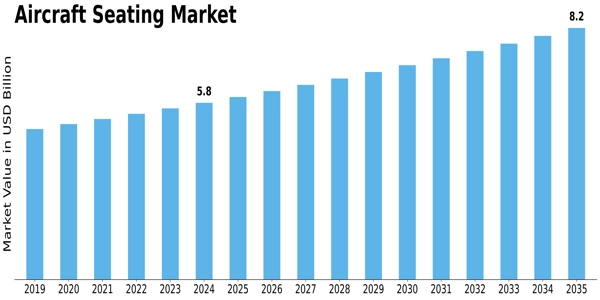

The aircraft seating market is quietly ascendant, mirroring broader growth in global air travel, fleet renewal and airline cabin-experience upgrades. A recent market assessment places the value at about USD 5.57 billion in 2023, rising to roughly USD 8.2 billion by 2035, with a projected CAGR of 3.26% from 2025 to 2035.

Industry Overview

At its core, the aircraft seating sector bridges aerospace hardware, interior design and passenger-experience engineering. Airlines today aim not just to transport travellers but to differentiate via cabin environments—comfort, connectivity, ergonomics and space. For seating-OEMs, this means meeting tighter weight budgets, faster turnaround/refit cycles, regulatory demands (fire/smoke/emissions) and cost constraints while still delivering innovation. Growth in narrow-body fleets, the premium economy segment and refurbishment programmes all feed into elevated demand.

Market Outlook

From a strategic viewpoint, the outlook for seating is promising though not explosive. Factors fueling growth: increasing global air passenger traffic, rising airline aspirations for cabin differentiation, retrofit of aging fleets, growth of regional and low-cost operations and the move toward lighter, smarter seating systems. Risks remain: slower replacement cycles (aircraft seats often last many years), certification lags, raw-material cost volatility and macroeconomic shocks (e.g., fuel price shocks or pandemics). Nonetheless, as cabin interiors become more important to airline branding and economics, seating plays an enabling role.

Key Players’ Role

Within this dynamic, several firms stand out. Sichuan Tengdun has secured a strong place through comprehensive product offerings across cabin classes and global supply-chain ties. Universal Aviation Seating, with a focus on premium and private sectors, brings customisation and high-end design cues. Recaro Aircraft Seating, Zodiac Aerospace and Thompson Aero Seating likewise contribute through global scale, innovation capabilities and close airline linkage. These players are innovating in lightweight structures, modular seats, connectivity-enabled features and sustainable materials—thus shaping market direction.

Segmentation Growth

Key growth contours can be seen in segmentation:

-

Seat Type: The economy segment dominates value, rising from USD 2.88 billion in 2024 to around USD 4.05 billion in 2035. Premium economy is becoming more popular, offering an intermediate option between economy and business class.

-

Material: Categories include leather, fabric, plastic and metal. The trend is toward materials that deliver lower weight without sacrificing durability or comfort. Plastics and lightweight metals/composites are increasingly preferred.

-

Aircraft Type / End-User: The bulk of demand stems from narrow-body aircraft, given their prevalence in global airline fleets. Wide-body and regional aircraft present additional niches. Commercial airlines are the major end-user; private and military aviation provide supplementary demand.

-

Region: North America held about USD 2.25 billion in 2024, leading globally. Europe and Asia-Pacific follow with substantial shares. Other regions like Latin America and Middle East & Africa are smaller but offer fast-growing potential.

Final Reflection

The seat inside an aircraft may appear mundane—but behind it lies a nexus of comfort, safety, engineering and economics. For airlines and suppliers alike, smart investment in seating design and materials can lead to differentiated passenger experience, cost efficiency and regulatory compliance. Over the next decade, those who lean into innovation, light-weight design and cabin-differentiation are likely to gain ground in this growing-but-steady market.