Unlocking the Airport of Tomorrow: Trends Powering the Biometrics Revolution

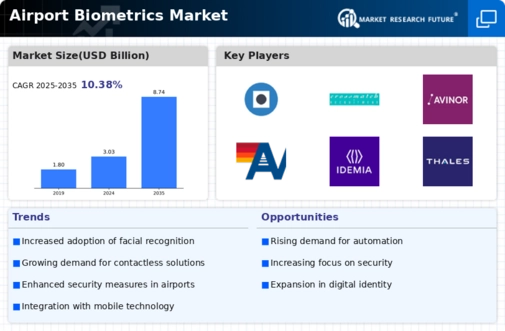

While the global airport biometrics market is rising, its growth and adoption are regionally uneven. Market Research Future provides breakdowns and projections by geography, offering insight into where momentum is greatest.

North America: The Leading Market

In 2023, North America commanded about USD 1.0 billion of the airport biometrics market value. By 2032, it is projected to grow to USD 2.44 billion, making it the region with the largest absolute share.

The reasons:

-

Strong regulatory and security infrastructure

-

Early adoption of biometric border / immigration systems

-

High capital budgets in major U.S. and Canadian airports

Europe: Steady Growth, Regulation-Driven

Europe held about USD 0.85 billion in 2023, expected to reach ~USD 2.1 billion by 2032. Though regulatory frameworks (e.g. GDPR) impose stringent privacy requirements, Europe’s mature aviation ecosystem and cross-border expansions (Schengen, EU) drive demand for interoperable biometric systems.

Asia-Pacific: Fastest Growth Potential

Asia-Pacific (valued ~USD 0.65 billion in 2023) is forecast to expand to USD 1.62 billion by 2032.

Key drivers include:

-

Rising air travel demand

-

New airport infrastructure and modernization projects

-

Government stimulus and digitization goals in nations like China, India, Southeast Asia

Latin America & MEA (Middle East & Africa)

These regions currently hold smaller shares—Latin America ~USD 0.1 billion and MEA ~USD 0.07 billion in 2023—but both are projected to grow meaningfully (0.23 B and 0.21 B by 2032 respectively).Growth may be slower, but urbanization, tourism growth, and international connectivity expansion offer fertile ground for biometric adoption.

Key Observations & Takeaways

-

Tiered adoption curve: large international hubs in developed regions adopt early, whereas emerging hubs and regional airports follow later.

-

Localization & regulation: regions differ in privacy laws, government policies, and willingness to adopt surveillance tech. Vendors must tailor to local norms.

-

Leapfrog potential: some emerging regions may bypass legacy systems and adopt modern, cloud / AI-enabled biometric deployments from the start.

-

Inter-regional interoperability demands: as travel grows, seamless biometric identity across regions (especially in ASEAN, EU, African Union) becomes strategic.

Conclusion

Understanding regional dynamics is crucial for strategic market prioritization. While North America and Europe give scale and stability, Asia-Pacific and emerging regions present high-growth potential and opportunity for differentiated market entry strategies.