Global Aircraft Communication System Market: Industry Analysis, Size, Share & Avionics Trends 2026–2035

The Aircraft Communication System Market has become a cornerstone of modern aviation as global airlines, military forces, and general aviation operators invest heavily in robust and secure airborne communication technologies. These systems are essential for ensuring flight safety, enabling real-time data exchange between aircraft and ground stations, and supporting voice communications among crew, passengers, and air traffic control. The market’s size and share have expanded significantly in recent years, driven by rapid advancements in avionics, increasing air traffic, and the growing demand for enhanced connectivity across commercial and defense aviation sectors.

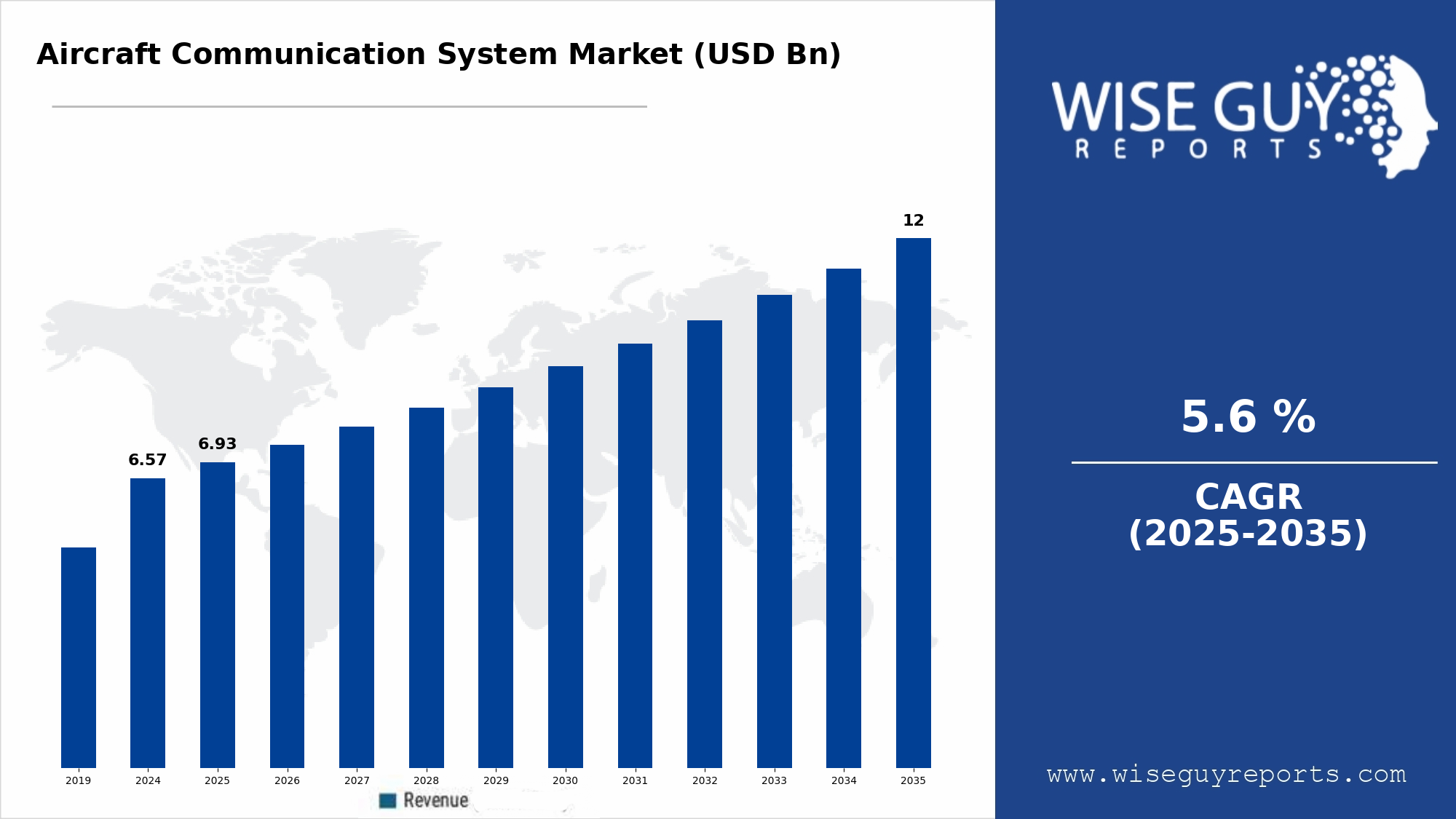

According to recent global market research data, The Aircraft Communication System Market is expected to grow from 6.93 USD Billion in 2025 to 12 USD Billion by 2035. The Aircraft Communication System Market CAGR (growth rate) is expected to be around 5.6% during the forecast period (2025 - 2035). This trajectory reflects sustained investments in advanced communication systems that support both critical safety protocols and emerging connectivity requirements.

One of the primary drivers of Aircraft Communication System Market growth is the exponential rise in global air travel, which has increased the need for reliable communication technologies that can manage complex air traffic environments. Airlines worldwide are upgrading their fleets with advanced communication suites to improve pilot-to-ground and cockpit-to-cabin communication, as well as to support in-flight connectivity services that meet rising passenger expectations. Modern aircraft demand integrated communication platforms capable of facilitating satellite communications (SATCOM), data link systems, and next-generation digital avionics — all contributing to the expansion of the market.

Technological innovation remains a key trend shaping the aircraft communication system industry. The integration of software-defined radios (SDRs), high-speed satellite links, and digital data transmission capabilities has transformed communication architectures within aircraft. SATCOM technology, for example, commands a significant share of the market due to its ability to support high-bandwidth data and voice communications over vast distances, which is essential for long-haul flights and remote operations. At the same time, emerging technologies such as 5G air-to-ground communications are gaining traction, offering low-latency options that complement traditional satellite links.

In terms of market share, North America remains the largest regional contributor, driven by high aircraft production rates, substantial defense spending, and the presence of major avionics suppliers and aerospace manufacturers. The region’s dominant status is reinforced by its leading commercial hubs and advanced air traffic control infrastructure. Asia-Pacific, however, is poised to be the fastest-growing region, supported by rapid expansion of airline fleets, increasing aircraft deliveries, and rising investments in aviation infrastructure and defense capabilities.

The industry analysis also highlights the importance of segment diversity. By component type, antennas, transceivers, and software-defined radios remain core revenue contributors, reflecting the growing complexity of communication systems onboard modern aircraft. By system type, radio communication, data link communication, and cockpit voice systems are critical for maintaining airspace coordination and operational safety. The commercial aviation segment accounts for a significant portion of revenue due to its sheer fleet size, but defense and general aviation also represent substantial demand pools, especially for secure and resilient communication technologies.

Challenges persist despite the positive outlook. High integration costs, stringent certification requirements, and concerns over cybersecurity in connected avionics systems continue to constrain faster adoption among smaller operators. Integration complexity between new digital systems and legacy avionics also poses hurdles for retrofit programs. However, ongoing investments in digitalization and the aviation industry’s shift toward connected, software-enabled aircraft architectures are expected to mitigate these constraints over time.

Looking ahead, the aircraft communication system market is positioned for sustained expansion as airlines, defense agencies, and aircraft manufacturers prioritize connectivity, safety, and efficiency. Market participants are investing in R&D to enhance communication performance while meeting emerging regulatory and safety standards. With the adoption of advanced communication technologies rising globally, the market’s forecast remains strongly optimistic through the end of the decade.