Rare Inherited Metabolic Disorder Drug Market: Patient Access and Treatment Adoption

The domain of contemporary healthcare is transforming. We are moving beyond the era of broad-spectrum, massive-selling pharmaceuticals toward therapies that are highly targeted and significantly impactful. Arguably, this evolution is most apparent within the sector for medications addressing Rare Inherited Metabolic Disorders.

For families managing conditions such as Phenylketonuria (PKU), Gaucher illness, or conditions affecting the Lysosomes (LSDs), these are more than just market segments they represent chances for life improvement. Data from Transpire Insight suggest the industry is undergoing a major change in how these illnesses are identified and managed, propelled by advances in biotechnology and a supportive regulatory landscape.

In this detailed examination, we will explore the monetary scope of the Rare Inherited Metabolic Disorder Drug sector, the figures encouraging financial commitment, and the expected state of affairs as we approach 2026.

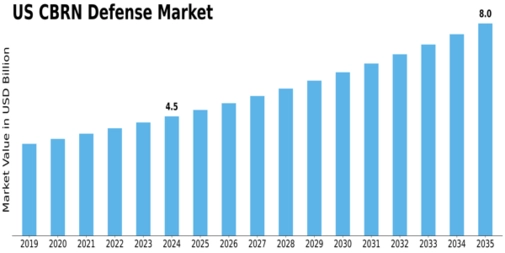

The Rare Inherited Metabolic Disorder Drug Market is experiencing steady growth, driven by rising diagnosis rates, advances in orphan drug development, and increasing healthcare investments. The market is projected to expand from USD 217.80 million in 2025 to around USD 530.10 million by 2033, registering a CAGR of 11.76% during 2026–2033. North America is expected to remain the largest market in 2026, supported by strong regulatory incentives, high awareness, and robust R&D activity.

What Constitute Rare Inherited Metabolic Disorders?

Before reviewing spreadsheets and growth rate percentages, it's vital to grasp the fundamental reason behind this market. Inherited metabolic disorders (IMDs) are genetic issues that disrupt the body's chemical processes. The majority of individuals with these conditions possess a flawed gene leading to a lack of necessary enzymes.

Picture your body as an advanced culinary facility. In a healthy person, enzymes function as assistant chefs, breaking down raw materials (fats, proteins, or sugars) into usable energy. In someone with an IMD, one of those key assistant chefs is missing. The materials accumulate, potentially becoming poisonous, or the body cannot create the necessary "power" for proper function.

Because these ailments are "rare" often impacting fewer than one in 2,000 individuals they were historically neglected. However, the market for Rare Inherited Metabolic Disorder treatments has matured considerably as "Orphan Drug" designation regulations provided the necessary financial motivation for pharmaceutical companies to tackle these complex biological puzzles.

Scope and Economic Climate of the Rare Inherited Metabolic Disorder Drug Market

When assessing the size of the Rare Inherited Metabolic Disorder Drug market, we observe an expansion trend that surpasses many larger pharmaceutical areas. This upward movement isn't solely attributable to premium pricing; it reflects a substantial rise in the number of manageable conditions.

The Statistics Fueling Expansion

Current statistics related to Rare Inherited Metabolic Disorder Drugs indicate that the worldwide market is anticipated to expand at a Compound Annual Growth Rate (CAGR) above 8% through the midpoint of this decade. As Transpire Insight has pointed out, several elements contribute to this valuation:

1. Enhanced Screening at Birth: Early detection is the chief driver of market volume. When a disorder is identified immediately after birth, therapy commences right away, resulting in continuous lifetime treatment.

2. Technological Leaps: The transition from basic enzyme substitute therapy (ERT) to advanced techniques like gene editing and mRNA-based treatments is carving out new sub-sectors within the market.

3. Governmental Backing: Policies established by the FDA (US) and EMA (EU) offer R&D tax benefits and periods of market exclusivity, making the "rare" space highly lucrative for firms focused on heavy scientific development.

In-Depth Sector Analysis for Rare Inherited Metabolic Disorder Drugs

To genuinely comprehend the marketplace for Rare Inherited Metabolic Disorder Drugs, one must examine the specific treatment categories that lead this space.

1. Enzyme Replacement Therapy (ERT)

ERT remains the established "benchmark" for numerous conditions, particularly Lysosomal Storage Disorders. By administering the absent enzyme intravenously, clinicians can stabilize patients and avoid organ deterioration. Though efficacious, ERT often necessitates a lifelong regimen, contributing to the stable, recurring income seen in Rare Inherited Metabolic Disorder Drug statistics.

2. Substrate Reduction Therapy (SRT)

If ERT installs the "missing chef" in the kitchen, SRT decreases the volume of "ingredients" being supplied. By slowing down the creation of the molecule the body cannot process, SRT averts toxic accumulation. This oral alternative to infusions is a growth area within the Rare Inherited Metabolic Disorder Drug sector.

3. The Cutting Edge: Gene and Cell Therapy

This represents the "ultimate objective." Rather than just managing symptoms, gene therapy seeks to correct the foundational genetic error. Although the initial expenditure is enormous sometimes reaching millions per single dose the long-term return on investment is substantial, as it potentially offers a definitive cure.

Market Forces: Boosters and Hindrances

Preparing a report or whitepaper on the Rare Inherited Metabolic Disorder Drug market necessitates an impartial assessment of both the elements accelerating and restricting progress within the industry.

The Accelerators

* Patient Advocacy: Organizations such as the National Organization for Rare Disorders (NORD) have become influential representatives, ensuring that funding and expedited approval processes remain prioritized.

* AI in Drug Discovery: Artificial intelligence is being utilized to pinpoint prospective drug compounds for rare proteins much more quickly than traditional methods, thus shortening the research and development timeline.

The Restraints

* High Treatment Expenditure: The most significant issue is pricing. Certain treatments cost well over $300,000 annually. Purchasers (insurers and governments) are increasingly pushing back, demanding pricing models based on proven efficacy.

* Clinical Trial Complexity: Recruiting sufficient participants for a study when the illness affects only a few hundred individuals globally presents a major operational challenge.

Looking Ahead: The Rare Inherited Metabolic Disorder Drug Market in 2026

As we anticipate the 2026 projections for the Rare Inherited Metabolic Disorder Drug market, several developments appear unavoidable.

Personalized Healthcare Becomes Standard

By 2026, we anticipate a more unified approach to treatment. Diagnostic procedures and therapeutics (theranostics) will advance in tandem. We won't just treat "Gaucher Disease"; we will address its specific genetic variation with a precisely tailored compound.

Geographical Expansion

While North America and Europe currently command the largest Rare Inherited Metabolic Disorder Drug market share, the Asia-Pacific region is the "dormant giant." Enhancements in medical infrastructure in China and India, coupled with a vast population base, suggest that the need for rare disease treatments is poised to surge in these areas.

Rare Inherited Metabolic Disorder Drug Statistics: A Data-Focused Overview

To convey a clear picture for financiers and interested parties, we present the core Rare Inherited Metabolic Disorder Drug statistics provided by Transpire Insight:

* Market Dominance: The top five firms currently control almost 45% of the market, though specialized biotechnology startups are rapidly gaining traction.

* Pipeline Vitality: Over 400 medicines are presently in various phases of clinical testing specifically targeting inherited metabolic conditions.

* Identification Lag: Despite advances, the "diagnostic quest" the duration required for a patient with a rare condition to receive the correct diagnosis averages five years. Eliminating this delay is the greatest opportunity for market expansion.

The Part Played by Transpire Insight

In an industry characterized by complexity, possessing access to precise figures is crucial. Transpire Insight furnishes the deep market analysis for Rare Inherited Metabolic Disorder Drugs that leaders require for sound decision-making. Their documentation goes past superficial figures, delving into the regulatory obstacles, competitive environments, and technological shifts that define the Rare Inherited Metabolic Disorder Drug market.

Whether you seek a comprehensive Rare Inherited Metabolic Disorder Drug market PDF for internal planning or need the newest Rare Inherited Metabolic Disorder Drug statistics to substantiate an investment, Transpire Insight delivers the specific detail needed in this high-stakes field.

Why This Market Holds Significance (Above Financial Gains)

It is easy to become engrossed in discussions of "market valuation" and "CAGR," but the Rare Inherited Metabolic Disorder Drug market is unique due to its human effect. Unlike common illnesses where a medication might slightly improve a condition, these drugs frequently determine whether a child survives past their fifth birthday or not.

The "valuable information" aspect of this sector isn't merely about composing articles; it’s about the reality that every small expansion in the Rare Inherited Metabolic Disorder Drug market size signifies a fresh cohort of patients who finally have a therapeutic path where previously none existed.

Strategic Counsel for Stakeholders

If you are active in the Rare Inherited Metabolic Disorder Drug market, consider these three foundational elements for achievement:

1. Prioritize Patient Focus: The most successful companies in this space do more than dispense medicines; they supply comprehensive support systems, including genetic guidance and infusion coordination.

2. Utilize Real-World Evidence (RWE): Given small clinical trial sizes, regulatory bodies are increasingly accepting RWE data gathered outside conventional studies to validate drug approvals.

3. Cooperative R&D: The expense of failure is high. We are observing an increase in "co-opetition," where major pharmaceutical corporations team up with academic centers or smaller biotech firms to share the risk of early-stage exploration.

Conclusion: A Promising Outlook for 2026 and Beyond

The Rare Inherited Metabolic Disorder Drug market stands at an intersection of optimism and advanced technology. Moving toward 2026, the emphasis will shift from merely discovering "a" treatment to finding the "most effective and accessible" intervention.

The expansion in the size of the Rare Inherited Metabolic Disorder Drug market is proof of human resourcefulness and the commitment to not abandon "rare" patients. With ongoing insights from organizations like Transpire Insight, the industry is well-prepared to manage the forthcoming regulatory and economic hurdles.

The journey of a thousand miles commences with a single stride or in this context, a single genetic code. As our comprehension of the human blueprint deepens, the market for Rare Inherited Metabolic Disorder Drugs will surely continue to be