How Corporate Advisory Services in the UAE Support Mergers and Acquisitions and mention above corporate advisory services,

How Corporate Advisory Services in the UAE Support Mergers and Acquisitions empower businesses to execute seamless deals in a market ripe for consolidation amid 4.5% GDP growth. These corporate advisory services, particularly corporate advisory services in Dubai and corporate advisory services in UAE, provide end-to-end expertise from valuation to integration, unlocking value in DIFC's $4T ecosystem.

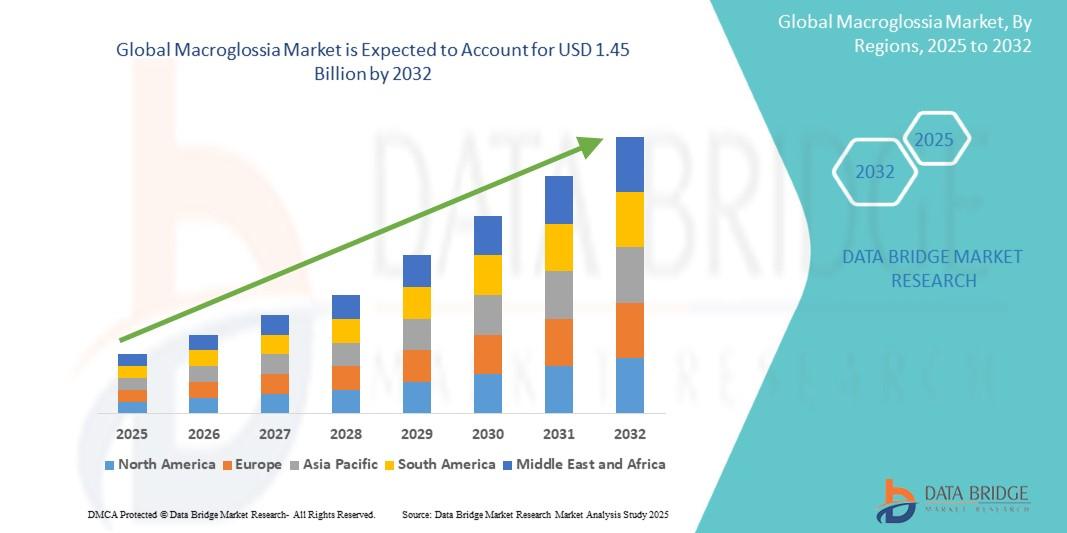

UAE's M&A Landscape Boom

Dubai leads with cross-border deals fueled by free zone incentives, UAE-India pacts, and 2025 tax clarity (9% corporate rate). Transaction volumes hit $20B annually, targeting fintech, logistics, and real estate, but complexities like due diligence and regulatory approvals demand specialized corporate advisory services in UAE. Advisors mitigate risks, ensuring 80% deal success vs. 50% without support.

Core M&A Support Services

Corporate advisory services in Dubai deliver comprehensive frameworks:

-

Valuation & Modeling: DCF analysis, synergy projections for accurate pricing.

-

Due Diligence: Legal, financial, operational audits uncovering hidden liabilities.

-

Deal Structuring: Share swaps, earn-outs aligned with FTA rules.

-

Negotiation & Closing: Term sheet drafting, escrow management.

-

Post-Merger Integration: Culture alignment, IT consolidation for 30% efficiency gains.

Tailored retainers cover startups to family offices scaling regionally.

Proven Impact Metrics

| M&A Phase | Advisory Value | Quantified Outcome | UAE Example |

|---|---|---|---|

| Pre-Deal Valuation | Fair market pricing | 25% premium capture | DIFC fintech buys |

| Due Diligence | Risk identification | 90% liability avoidance | JAFZA trader mergers |

| Negotiation | Optimal terms | 15-20% better pricing | DMCC asset deals |

| Integration | Synergy realization | 35% EBITDA uplift | Cross-emirate consolidations |

| Compliance | Regulatory approvals | 2x faster closings | 2025 tax navigation |

Advisors boost ROI by 40% through proactive strategies.

2025 M&A Trends and Enablers

-

Digital Assets: Blockchain due diligence for crypto firms.

-

ESG Focus: Sustainability audits attracting green investors.

-

Family Office Deals: Succession M&As with $1T wealth transfer.

Corporate advisory services in UAE interpret SCA/DFSA updates, capitalizing on lower rates and IPO surges.

Step-by-Step M&A Roadmap

-

Opportunity Scan: Target identification via market intel (1-2 weeks).

-

Valuation Deep-Dive: Financial modeling, LOI drafting.

-

Due Diligence Execution: 4-6 week audits with specialist teams.

-

Negotiation & SPA: Binding agreements, regulatory filings.

-

Closing & Integration: Day 1 planning, 90-day synergy tracking.

Fees range AED 50K-500K, yielding 5-10x returns on successful exits.

Real Deal Success Stories

-

European tech acquired UAE rival via corporate advisory services in Dubai, hitting AED 15M synergies.

-

Indian trader merged in JAFZA, expanding 3x post-advisory integration.

-

Family office consolidated assets, securing $30M funding.

Seize UAE M&A Momentum

With President Trump's US-UAE boost and Expo 2030, corporate advisory services in UAE are non-negotiable for deal-makers. They simplify complexities, maximize value, and drive growth.