How Businesses Can Prepare for Corporate Tax Reviews Without Panic

Corporate tax reviews often trigger anxiety among business owners and finance teams. The thought of regulatory scrutiny, document requests, and potential adjustments can create unnecessary stress. However, tax reviews are a normal part of regulatory oversight, and businesses that prepare proactively can handle them smoothly and confidently.

Preparation is not about reacting at the last minute—it is about building systems, maintaining accurate records, and ensuring compliance throughout the year. Businesses that follow this approach can face tax reviews without panic or disruption.

Understanding the Purpose of Corporate Tax Reviews

Corporate tax reviews are designed to verify the accuracy of reported financial information and ensure compliance with applicable regulations. Authorities assess whether income, expenses, and deductions are properly recorded and supported by documentation.

Viewing reviews as routine checks rather than threats helps businesses approach them objectively. This mindset encourages proactive preparation and reduces fear-driven responses that often lead to mistakes.

Maintain Organized and Accurate Financial Records

The foundation of a smooth tax review is accurate record-keeping. Businesses should maintain organized financial records that clearly document income, expenses, and transactions.

Best practices include:

-

Recording transactions promptly

-

Retaining invoices, receipts, and contracts

-

Using consistent accounting classifications

-

Reconciling accounts regularly

When records are complete and well-organized, responding to review requests becomes straightforward, reducing stress and uncertainty.

Conduct Regular Internal Reviews

Waiting until a tax review begins to examine records can create unnecessary pressure. Regular internal reviews help identify inconsistencies early and allow businesses to correct them before they escalate.

Periodic checks of financial statements, reconciliations, and supporting documents ensure accuracy. This ongoing process minimizes surprises during formal reviews and reinforces confidence in reported figures.

Establish Clear Documentation Processes

Clear documentation processes ensure that every transaction is traceable and verifiable. Businesses should standardize how documents are stored, labeled, and retrieved.

Digital document management systems can improve accessibility and reduce the risk of missing records. Having a clear audit trail simplifies communication with authorities and demonstrates a commitment to compliance.

Align Tax Reporting With Business Activities

Discrepancies often arise when tax reporting does not reflect actual business activities. Ensuring alignment between operational practices and reported figures is critical.

Changes in revenue streams, expense structures, or operational models should be documented and reflected accurately in tax filings. Consistency reduces the likelihood of questions during reviews.

Manage Deadlines and Communication

Timely responses are essential during tax reviews. Delays can raise concerns and prolong the process.

Businesses should assign responsibility for managing communications with authorities and ensure deadlines are tracked carefully. Clear and prompt responses demonstrate professionalism and cooperation, helping reviews proceed smoothly.

Reduce Risk Through Professional Support

Professional guidance can significantly reduce anxiety during tax reviews. Working with a corporate tax consultant helps businesses assess readiness, review records, and address potential issues before reviews occur.

Consultants provide objective insights, clarify regulatory expectations, and assist in preparing responses. Their involvement ensures accuracy and reduces the risk of miscommunication or errors.

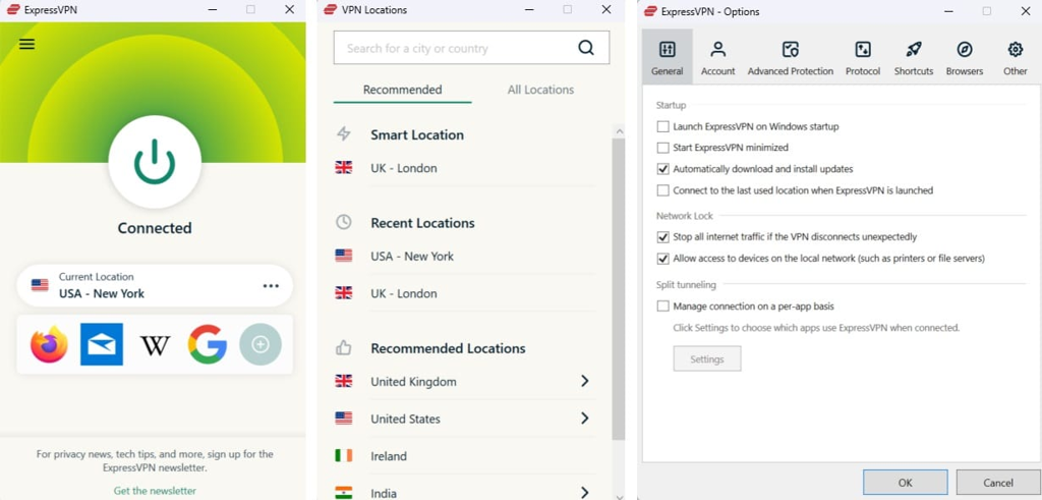

Use Technology to Support Review Readiness

Technology plays an important role in maintaining review-ready systems. Accounting software, automated reporting tools, and digital record storage improve accuracy and accessibility.

These tools allow businesses to generate reports quickly, retrieve documents efficiently, and maintain clear audit trails. Technology reduces reliance on manual processes, minimizing errors and saving time during reviews.

Train Teams and Assign Accountability

Preparation extends beyond systems—it involves people. Employees responsible for financial records should understand compliance requirements and documentation standards.

Training ensures consistency and reduces the risk of errors caused by misunderstandings. Assigning clear accountability for record-keeping and reporting promotes ownership and preparedness.

Stay Calm and Proactive During Reviews

When a tax review begins, staying calm is essential. Businesses that have prepared proactively can approach reviews with confidence.

Responding accurately, providing requested documentation, and maintaining open communication help build trust with authorities. Panic-driven reactions often lead to rushed responses and mistakes, while calm professionalism supports favorable outcomes.

Conclusion

Preparing for corporate tax reviews does not require panic or last-minute effort. By maintaining accurate records, conducting regular internal reviews, establishing clear documentation processes, and leveraging professional guidance, businesses can handle reviews confidently.

Proactive preparation transforms tax reviews from stressful events into routine compliance checks. In an increasingly regulated environment, readiness, organization, and calm execution are the keys to navigating corporate tax reviews successfully.