South Korea Automotive Lubricants Size, Share, Industry Overview, Trends and Forecast 2026-2034

IMARC Group has recently released a new research study titled “South Korea Automotive Lubricants Market Size, Share, Trends and Forecast by Vehicle Type, Product Type, and Region, 2026-2034”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

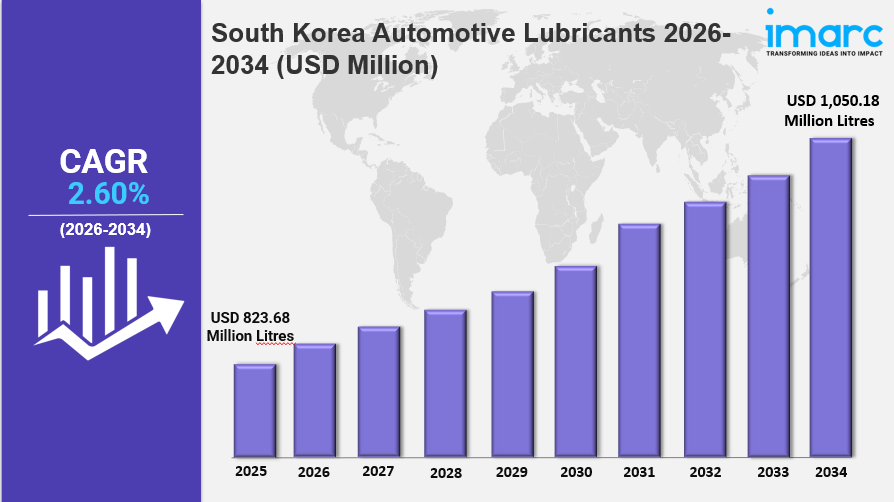

The South Korea automotive lubricants market size was valued at 823.68 million Litres in 2025 and is projected to reach 1,050.18 million Litres by 2034, growing at a CAGR of 2.60% during 2026-2034. The market growth is driven by increasing vehicle ownership, rapid urbanization, and the rising adoption of electric and hybrid vehicles demanding high-performance, eco-friendly lubricants. Technological advancements and government initiatives further support demand across passenger and commercial vehicle segments.

Study Assumption Years

- Base Year: 2025

- Historical Year/Period: 2020-2025

- Forecast Year/Period: 2026-2034

South Korea Automotive Lubricants Market Key Takeaways

- Current Market Size: 823.68 million Litres (2025)

- CAGR: 2.60% (2026-2034)

- Forecast Period: 2026-2034

- Seoul Capital Area dominates the market due to high vehicle density and urban population.

- Passenger vehicles hold approximately 58.96% market share in 2024.

- Engine oils lead the product type segment with around 55.4% share in 2024.

- Rising vehicle ownership and increasing adoption of eco-friendly vehicles drive lubricant demand.

- Growth of logistics and e-commerce sectors boosts commercial vehicle lubricant needs.

Sample Request Link: https://www.imarcgroup.com/south-korea-automotive-lubricants-market/requestsample

Market Growth Factors

The South Korea automotive lubricants market is propelled by rising vehicle ownership, with over 26 million registered cars in 2024 and more than 10% being environmentally friendly vehicles. Increasing urbanization and lifestyle changes have spurred higher consumption of engine oils, transmission fluids, and other lubricants, particularly in metropolitan areas such as Seoul, Incheon, and Busan. Commercial fleet expansions in logistics and delivery services further amplify demand in light commercial and heavy-duty truck segments.

Environmental policies aimed at achieving carbon neutrality by 2050 and reducing greenhouse gas emissions by 40% by 2030 have accelerated demand for high-quality synthetic and semi-synthetic lubricants that offer oxidative stability, lower volatility, and fuel economy benefits. Government incentives promoting eco-friendly vehicles and enhanced emission standards enable continuous product innovation, including lubricants designed for modern internal combustion engines and premium formulations with biodegradability and low ash content.

The increasing penetration of electric and hybrid vehicles is reshaping lubricant requirements. South Korea aims to have 4.5 million battery electric and fuel cell vehicles by 2030, representing 16.7% of the registered automobiles. Lubricants with excellent dielectric properties and thermal conductivity are essential for electric vehicle components. Hybrid vehicles also require lubricants capable of performing under diverse temperature ranges and intermittent operation. Collaborations between automakers and lubricant manufacturers foster development of EV-specific fluids, supported by expanding charging infrastructure and government subsidies.

Market Segmentation

By Vehicle Type:

- Commercial Vehicles: Lubricants for commercial transportation, driven by logistics and delivery fleet growth.

- Passenger Vehicles: Lead the market with about 58.96% share in 2024, supported by rising vehicle ownership, frequent maintenance, and demand for synthetic and semi-synthetic lubricants.

By Product Type:

- Engine Oils: Comprise about 55.4% of market share in 2024, driven by stringent vehicle maintenance requirements and advanced engine designs requiring premium lubricants.

Ask For an Analyst- https://www.imarcgroup.com/request?type=report&id=21911&flag=C

Regional Insights

Seoul Capital Area is the dominant region in the South Korea automotive lubricants market in 2024. It benefits from high vehicle density and urban population combined with sophisticated service infrastructure and extensive dealership networks. Consumers therein prefer premium, synthetic, and semi-synthetic lubricants that meet stringent emission regulations. This dominance is supported by robust private and commercial vehicle ownership levels.

Recent Developments & News

- February 2025: S-OIL TotalEnergies Lubricants Co., Ltd. launched a new line of engine oils compliant with API SQ and ILSAC GF-7 standards, enhancing fuel efficiency and engine protection.

- January 2025: FUCHS SE and Dumarey Group introduced a lubricant tailored for hydrogen internal combustion engines. FUCHS LUBRICANTS (KOREA) LTD. offers automotive lubricants with proprietary XTL® technology.

- November 2024: Hi-Tech Lubricants Limited (HTL) began local blending and packaging of synthetic lubricants under the ZIC brand through a partnership with SK Enmove, aiming to reduce import costs and enhance competitiveness.

- April 2024: Schaeffler Automotive Aftermarket Korea launched 'Schaeffler TruPower' commercial vehicle coolant optimized for high-load conditions, sold in 4L packs.

Competitive Landscape

The competitive landscape of the market is characterized by high competition, with companies concentrating on innovations, quality enhancements, and growth in premium product offerings. The market is dominated by a high demand for synthetic and semi-synthetic lubricants due to the high standards of vehicle maintenance in the country and fuel efficiency requirements. Additionally, firms are heavily investing in research and development (R&D) activities to develop sophisticated formulations that satisfy more stringent emission standards and performance levels. Branding, post-sales support, and localized marketing strategies also contribute significantly to achieving consumer loyalty. Furthermore, distribution channels are well developed, ranging from authorized dealerships, service centers, independent garages, and online platforms. Pricing strategies are well-calibrated to provide valuable products without sacrificing quality, particularly in the synthetic segment. According to the South Korea automotive lubricants market forecast, sustainability trends are expected to significantly influence product innovation, with manufacturers projected to expand their portfolios of environmentally friendly lubricants to align with rising eco-consciousness among consumers.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302