Monetizing Motion: A Look at Motor Driver IC Revenue Models

The generation of Motor Driver IC revenue is a classic semiconductor industry business model, built almost entirely on the high-volume sale and shipment of the physical integrated circuits (ICs). As the market continues its strong and steady growth, with its valuation projected to reach an impressive $67.06 billion by 2035, this straightforward, transactional model remains the financial lifeblood of the industry. This financial growth, which is forecast to advance at a compound annual growth rate of 10.49% between 2025 and 2035, is driven by the simple but powerful economics of selling billions of essential components to a vast and diverse global customer base, creating a massive and highly profitable market for the leading semiconductor manufacturers.

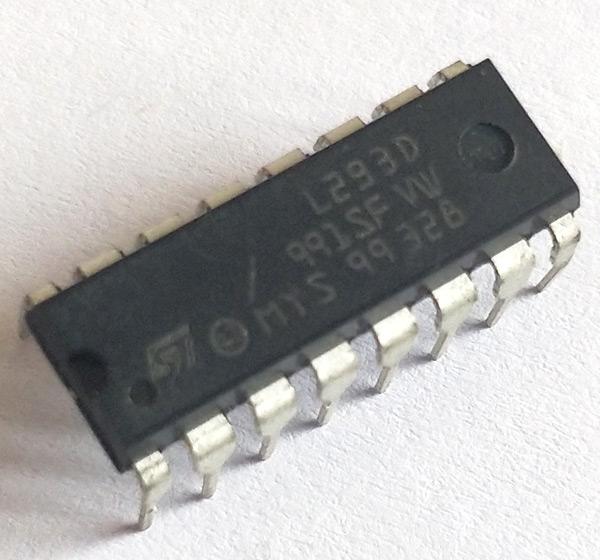

The primary and overwhelming revenue stream for the vendors in this market is the direct sale of their chips to original equipment manufacturers (OEMs) and their contract manufacturers. A motor driver IC company generates its revenue based on two key factors: the total number of units (chips) it ships and the average selling price (ASP) of those units. The business is a game of volume. The key to success is securing a "design win," where a company's chip is selected to be used in a high-volume end product, such as a new car model, a popular power tool, or a flagship smartphone. A single design win in a product that sells millions of units can result in a massive and recurring stream of revenue for the chip vendor for the entire production life of that product.

The pricing of motor driver ICs, and therefore the revenue generated, varies significantly based on the complexity and performance of the chip. A simple, low-voltage driver for a small brushed DC motor used in a toy might sell for well under a dollar. In contrast, a highly sophisticated, automotive-grade, multi-channel driver for a brushless DC motor used in an electric power steering system might have an ASP of ten dollars or more. The revenue model for the vendors is to offer a very broad portfolio of products at different price points to serve the needs of a wide range of applications, from low-cost consumer goods to high-reliability industrial and automotive systems.

While direct chip sales are the core, vendors also generate revenue through their distribution channels. The major semiconductor companies do not sell all of their chips directly to the largest OEMs. A significant portion of their revenue comes from selling their products to large, global electronic component distributors like Arrow Electronics or Avnet. These distributors then hold inventory and resell the chips in smaller quantities to thousands of smaller and medium-sized businesses that the chipmaker cannot serve directly. This distribution channel is a critical part of the industry's go-to-market strategy, allowing the vendors to reach the entire "long tail" of the market and creating another massive revenue channel for their products.

Explore Our Latest Trending Reports:

Artificial Intelligence In Life Science Market