Self-storage Market Growth: Key Catalysts, Projections, and Investment Opportunities Fueling Rapid Expansion

The Self-storage Market Growth trajectory points to sustained acceleration, propelled by demographic megatrends and digital commerce. From 2023 baselines, compound growth nears 8% annually, transforming it into a high-yield asset class.

Primary catalysts include urbanization: 68% global population urban by 2050 demands off-site solutions. E-commerce, projected to hit $8 trillion, amplifies commercial uptake—think Shopify sellers needing buffer stock.

Pandemic legacies endure: remote work swells home goods storage during relocations. Life events like marriages/divorces spike episodic demand.

Infrastructure synergies drive growth; highway proximity boosts accessibility, evident in U.S. Sun Belt booms.

Innovation catalyzes: modular prefab units slash build times 50%, enabling swift scaling. Mobile apps cut acquisition costs 30%.

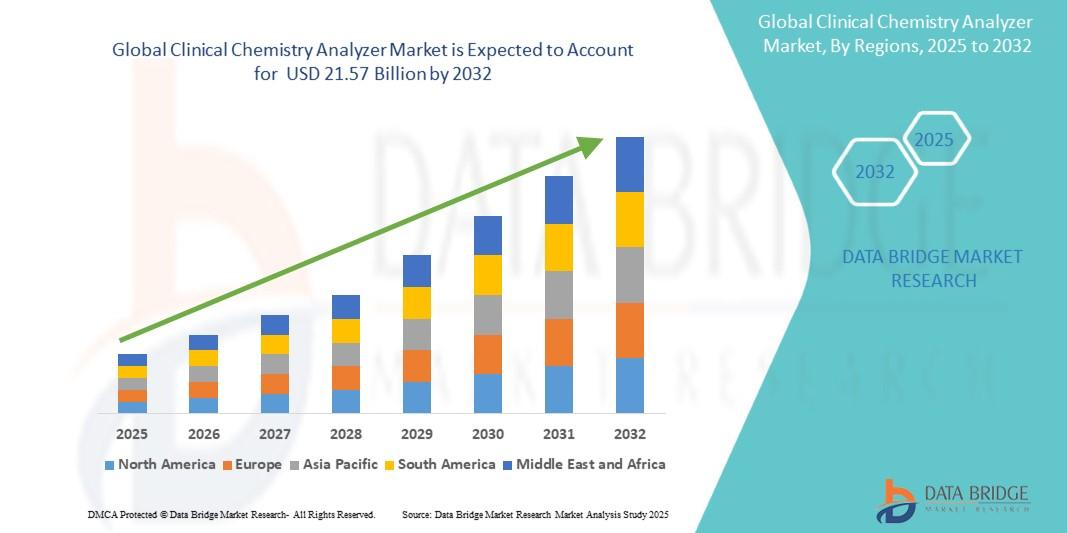

Regional growth dissected: North America matures at 5%; Europe 7%; APAC explodes at 11%, with India's formalization from unorganized players.

Investment growth avenues abound: private equity funnels billions into portfolios yielding 7-10% NOI. REITs like PSA offer liquid exposure.

Barriers to growth—land acquisition, permitting delays—are mitigated by brownfield redevelopments.

Sustainability growth: ESG funds target facilities, unlocking green financing.

Projections to 2032: market doubles, with premium segments (climate-controlled) outpacing basics.

Growth strategies: geographic diversification, vertical integration with logistics, tech stack upgrades.

Investors capitalize via development yields (15%+ IRR) or stabilized assets (stable dividends).

Self-storage growth epitomizes resilient prosperity amid uncertainty.

Top Trending Reports: