What Is Gross Profit Margin? The Essential Guide to Measuring Core Profitability

In the intricate world of business finance, few metrics are as fundamental and revealing as the Gross Profit Margin (GP Margin). It serves as the first critical check-up on a company's financial health, acting as a litmus test for its core production or service delivery efficiency. Unlike top-line revenue, which simply states how much money a business brings in, GP Margin delves deeper. It answers a pivotal question: After accounting for the direct costs of making our product or delivering our service, how much money do we actually have left to cover everything else?

This article is a comprehensive guide to Gross Profit Margin. We will move beyond the basic formula to explore its profound significance, how to calculate it accurately across different business models, and—most importantly—how to interpret its movements and implement strategies for its improvement. For entrepreneurs, managers, and investors alike, mastering the nuances of GP Margin is not just an accounting exercise; it's a crucial step toward building a resilient and profitable enterprise.

Understanding the Core: What is Gross Profit Margin?

Gross Profit Margin, often abbreviated as GP Margin or Gross Margin, is a financial ratio expressed as a percentage. It measures the proportion of revenue that exceeds the Cost of Goods Sold (COGS). In essence, it reveals the financial efficiency of a company's core operations before administrative, selling, and other overhead expenses are factored in.

Think of it as the story of a bakery. If the bakery sells a cake for $20 (revenue) and the direct costs—flour, eggs, sugar, the baker's labor to make that specific cake—total $8 (COGS), then the gross profit is $12. The GP Margin tells us that 60% of that $20 sale is retained as gross profit. This $12 is the crucial pool of money that must now pay for the shop's rent, utilities, marketing, and, ultimately, the net profit.

Why is this distinction so vital? Because a company can have soaring revenues but still be on the path to failure if its gross margins are too thin. High revenue with low GP Margin means there is very little left to cover operating expenses, leaving the business vulnerable.

The Fundamental GP Margin Formula and Calculation

The calculation of Gross Profit Margin is straightforward, but its components require precise understanding.

The Standard Formula is:

Gross Profit Margin = (Gross Profit / Revenue) x 100

Where:

-

Gross Profit = Revenue - Cost of Goods Sold (COGS)

-

Revenue (or Net Sales): The total income from sales, often adjusted for returns and discounts.

-

Cost of Goods Sold (COGS): The direct, variable costs attributable to the production of the goods sold or services delivered.

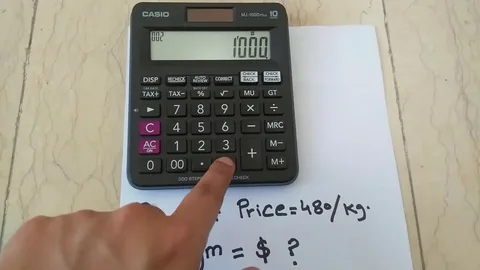

A Step-by-Step Calculation Example

Let's examine a hypothetical company, "TechGadget Inc.," which sold 1,000 units of a device last quarter.

-

Determine Revenue: They sold each unit for $150.

-

Total Revenue = 1,000 units * $150 = $150,000.

-

-

Determine COGS: The direct cost to produce each unit (materials, direct labor, factory overhead) is $65.

-

Total COGS = 1,000 units * $65 = $65,000.

-

-

Calculate Gross Profit:

-

Gross Profit = Revenue - COGS = $150,000 - $65,000 = $85,000.

-

-

Apply the GP Margin Formula:

-

GP Margin = ($85,000 / $150,000) x 100 = 56.7%.

-

This means for every dollar of revenue generated, TechGadget Inc. retains approximately 56.7 cents as gross profit before operating expenses.

What Constitutes Cost of Goods Sold (COGS)?

Accurately defining COGS is critical for an honest GP Margin. Misclassifying expenses here will distort the metric.

Typical COGS Components Include:

-

Raw Materials: The basic components used in production.

-

Direct Labor: Wages for employees directly involved in manufacturing or service delivery.

-

Factory Overhead: Utilities for the production facility, depreciation on manufacturing equipment, and rent for the production space.

-

Freight & Shipping Costs directly tied to production.

-

Direct Costs of Service Delivery: For service businesses, this often includes labor cost of the person delivering the service and any materials specifically used for a client.

Expenses NOT Included in COGS:

-

Marketing and advertising costs

-

Salaries for executives, sales teams, or administrative staff

-

Office rent and utilities

-

Distribution costs (post-production)

-

Research and Development (in most accounting frameworks)

GP Margin vs. Net Profit Margin: A Critical Distinction

While GP Margin is a superstar metric for operational efficiency, it's only part of the profitability story. It's essential to distinguish it from Net Profit Margin.

Gross Profit Margin focuses exclusively on the relationship between revenue and the direct costs of production. It isolates production efficiency.

Net Profit Margin is the ultimate bottom-line percentage. It is calculated as (Net Profit / Revenue) x 100, where Net Profit is what remains after ALL expenses are deducted: COGS, operating expenses (OpEx), interest, and taxes.

The Takeaway: A healthy GP Margin is a prerequisite for a healthy Net Profit Margin, but it does not guarantee it. A company can have a strong GP Margin but be unprofitable due to bloated administrative, sales, or interest expenses. Conversely, a company with a modest GP Margin can achieve solid net profitability through exceptional operational lean-ness in other areas.

Why is Monitoring GP Margin Essential for Business Health?

Tracking GP Margin over time provides invaluable strategic insights:

-

Benchmarking Core Efficiency: It is the primary indicator of how well a company is converting raw materials and labor into profit. A rising trend suggests improving efficiency or pricing power.

-

Pricing Strategy Validation: GP Margin directly reflects the effectiveness of your pricing. If margins are shrinking while COGS is stable, it may indicate competitive pressures forcing price cuts.

-

Cost Control Signal: A declining GP Margin can be an early warning sign of rising input costs (materials, labor) that need to be addressed through supplier negotiation or process redesign.

-

Informing Strategic Decisions: It is a key data point for decisions on discounting, launching new products, entering new markets, or making large capital investments.

-

Attracting Investors and Lenders: A stable or growing GP Margin is a strong signal to external stakeholders that the business has a viable, scalable core model.

Industry Benchmarks: What is a "Good" GP Margin?

There is no universal "good" GP Margin; it varies dramatically by industry. A software company (low COGS) will have margins that a grocery store (high COGS) could never dream of.

-

Software/SaaS: 70-85%+ (Primary costs are development, not physical goods)

-

Manufacturing: 30-50% (Varies widely with material and labor intensity)

-

Retail (General): 25-35% (Highly competitive, inventory-heavy)

-

Restaurants: 20-30% (High and volatile food & labor costs)

-

Construction: 15-25% (Project-based with significant direct costs)

The key is to benchmark against your direct competitors and your own historical performance, not against unrelated sectors.

How to Analyze Trends in Your Gross Profit Margin

Static analysis is useful, but trend analysis is powerful. Ask these questions:

-

Is our GP Margin trending upward, downward, or staying flat? A gradual upward trend typically indicates positive control over costs and pricing. A downward trend requires immediate investigation.

-

What is driving the change? Use variance analysis to isolate the cause:

-

Price Variance: Did average selling prices change?

-

Volume Variance: Did sales mix shift to higher or lower-margin products?

-

Cost Variance: Did the cost per unit of materials or labor increase?

-

-

Are we comparing apples to apples? Ensure consistency in how COGS and revenue are recognized, especially when comparing across periods.

Strategic Levers: How to Improve Your Gross Profit Margin

Improving GP Margin involves actions on two fronts: increasing revenue per unit or decreasing COGS per unit.

Strategies to Increase Revenue (The Top Line)

-

Strategic Price Increases: Justify with enhanced value, branding, or market positioning.

-

Upselling and Cross-Selling: Encourage customers to purchase higher-margin complementary products or premium versions.

-

Product Mix Optimization: Focus marketing and sales efforts on your highest-margin products or services.

-

Value-Added Services: Bundle products with high-margin services (e.g., installation, training, maintenance).

Strategies to Reduce COGS (The Cost Line)

-

Supplier Negotiation: Seek volume discounts, more favorable payment terms, or explore alternative suppliers.

-

Improve Operational Efficiency: Reduce waste (e.g., lean manufacturing), streamline production processes, and invest in automation to lower direct labor costs over time.

-

Inventory Management: Implement Just-In-Time (JIT) systems to reduce holding costs and the risk of obsolescence.

-

Product Redesign: Reformulate products or redesign services to maintain quality while using less expensive or more efficient materials/components.

Common Pitfalls and Misconceptions About GP Margin

-

"A High GP Margin Means the Business is Highly Profitable." False. It means the core activity is efficient, but high operating expenses can still lead to losses.

-

"GP Margin is the Only Metric That Matters." False. It must be analyzed alongside operating cash flow, net margin, and inventory turnover for a complete picture.

-

"Cutting COGS Always Improves GP Margin." Not always. Aggressive cost-cutting that compromises product quality can reduce revenue faster than it saves costs, harming the margin.

-

Ignoring the Sales Mix: A company with multiple products has an aggregate GP Margin. A shift in sales toward lower-margin items will drag down the overall margin, even if individual product margins are stable.

Conclusion: GP Margin as Your Financial Compass

Gross Profit Margin is far more than a simple percentage on a financial statement. It is a dynamic and powerful diagnostic tool that illuminates the fundamental efficacy of a business's core value-creation process. By routinely calculating, analyzing, and understanding the drivers behind your GP Margin, you gain unparalleled insight into your pricing power, cost control, and operational health.

Strategic improvement of this metric should be a continuous focus, balanced carefully with long-term brand and quality objectives. Whether you are a startup founder, a seasoned manager, or an investor performing due diligence, a deep comprehension of Gross Profit Margin provides the clarity needed to make informed, confident decisions that drive sustainable growth and profitability.

Frequently Asked Questions (FAQs)

Q1: Can Gross Profit Margin be over 100%?

No, a true Gross Profit Margin cannot exceed 100%. The formula is (Revenue - COGS) / Revenue. If COGS is zero (as is nearly the case with some digital products after development), the margin would approach 100% but not exceed it, as revenue is the denominator. A reported margin over 100% typically indicates an error in how COGS is calculated or defined.

Q2: How often should I calculate my business's GP Margin?

For active management, it is advisable to calculate GP Margin at least monthly. Many businesses with real-time POS or inventory systems track it even more frequently. This allows for timely identification of trends and quick corrective action.

Q3: What's the difference between Gross Margin and Markup?

They are often confused but are fundamentally different. Markup is the percentage added to the cost price to determine the selling price (e.g., a $5 cost with a 100% markup sells for $10). Gross Margin is the percentage of the selling price that is profit (e.g., a $10 sale with a $5 cost yields a 50% gross margin).

Q4: How does a service business calculate COGS and GP Margin?

For service businesses, COGS is often called "Cost of Services" (COS) or "Cost of Revenue." It includes the direct labor cost of the employees delivering the service, any directly attributable materials, and sometimes subcontractor fees. The GP Margin calculation remains the same: (Revenue - Direct Service Costs) / Revenue.

Q5: What does a fluctuating GP Margin indicate?

Fluctuations can be normal due to seasonality, promotional discounts, or bulk purchases. However, sustained or sharp fluctuations without clear cause can indicate problems like poor inventory management, inconsistent pricing, unreliable supplier costs, or a shifting sales mix that needs to be managed deliberately.